In anticipation for Brexit on the 1st January 2021, we’ve been busy adapting the system for these changes. Alongside more international-based updates, we’ve got new features to improve the way you’re handling and moving data within the system.

EU ICN Commodity Codes

Brexit EU commodity codes can now be defined against stock items, along with their complementary values. So, when you visit a stock item, you’re able to identity the ICN (Intrastat Commodity Number). This is a reference acknowledged by the European Union for categorising goods. ICNs are used when exporting goods overseas where they should be shown on official Customs Invoices.

Once defined, you’re then able to set up the Supplementary Units for each category. The Supplementary Unit Value works in combination with the ICN. ICNs are defined with a supplementary unit (for example, Litre or Kilogram). This value specifies the numeric value for this unit as defined against your products.

Country of Manufacture

In addition to ICNs, customers are now able to record the Country of Manufacture. The Country of Manufacture works in combination with the ICN and is mainly used on Customs Invoices and some Shipping labels to show where a product originates.

These three values, amongst various other categorisations, can then be shown on invoices for international sales. So, when it comes to sending items across the border, you’re able to print out a Customs Invoice with details ready to go. This ultimately makes it easier, and quicker for customs to identity what items they’re dealing with.

Harmonisation Codes

Harmonized System (HS) Codes allow for the categorisation of products into predefined classes that other countries agree on. They make it possible to report to other countries the type of product being sold or transported. This code is used for some Shipping Labels and for showing on Customs Invoices. Just like your ICN codes, once defined it can be assigned to Stock Items.

Note: Some destinations will require ICN codes, some will require Harmonisation codes.

EORI Number

An EORI Number is a reference number now required on invoices internationally. EORI number is the Economic Operator Registration and Identification number used by HMRC to identify you and collect duty on your goods. You are able to define this now in the System Values section of Khaos Control Cloud.

Country Tax

Alongside doing your traditional TAX (VAT) return for the UK and EU, the system can now track tax rates against different countries – allowing you to submit your Tax return(s) separately.

That means as a sale is put through, the system will pick-up the tax rate which is applicable to the items being sold, based on the invoice’s destination.

The system will also warn you when an item you’re trying to send out doesn’t have the right tax rates applied. Once issued, tax return data is collected, so that you can process your tax returns to various countries.

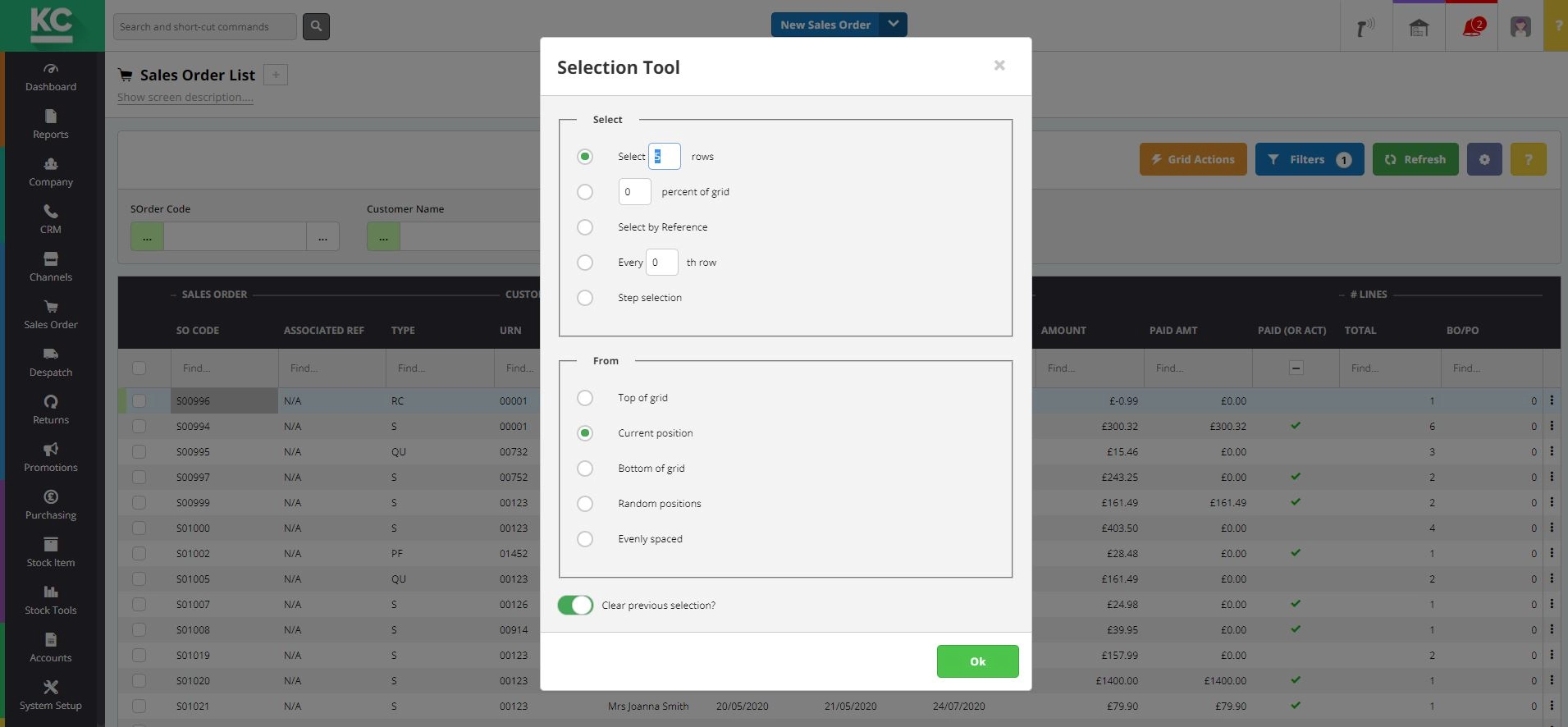

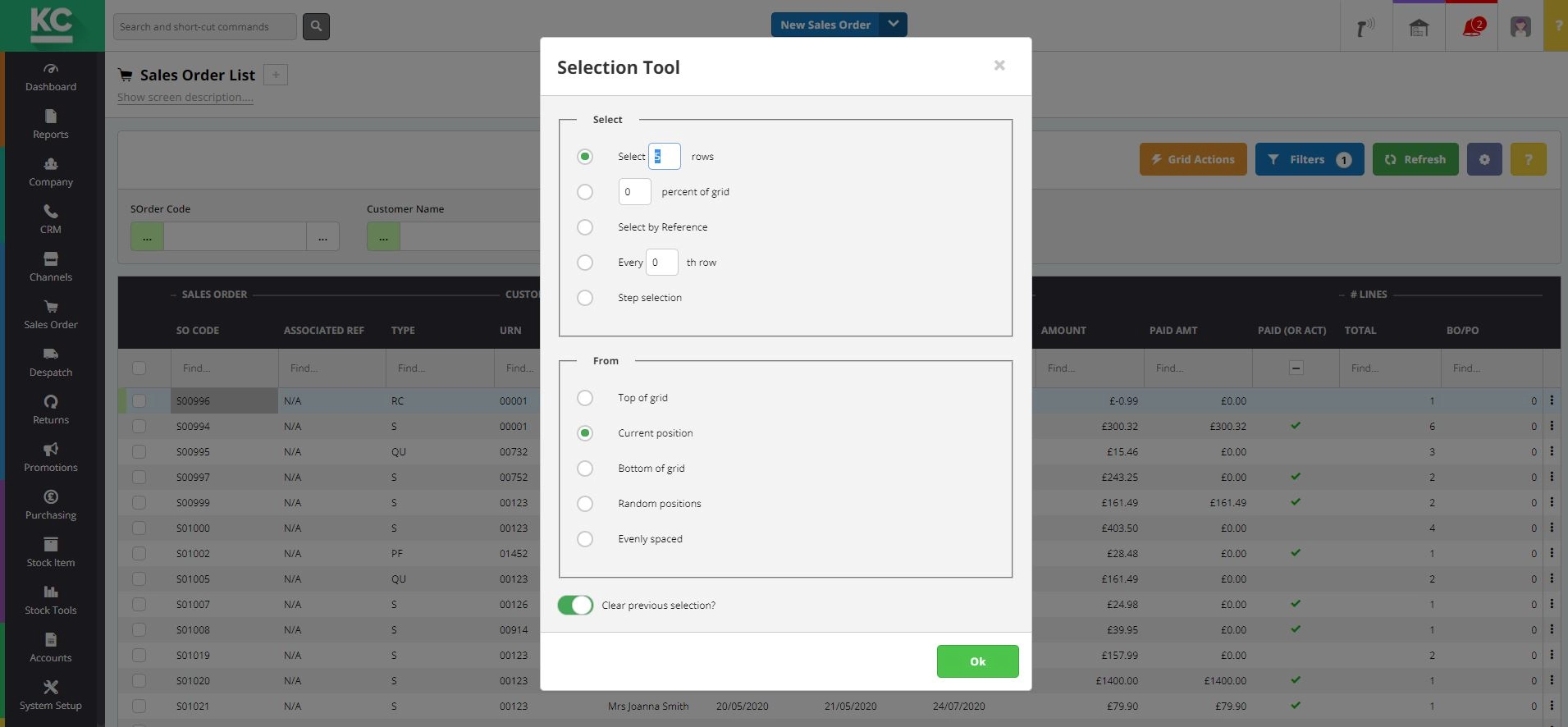

Selection Tools on Grid Menu

Khaos Control Cloud now allows you to select items from a grid in ways that suit your specific requirements. Whether selecting 50 items from a row of 200 from within the Sales Invoice Manager, or extracting sales data for analysis, our new selection tool makes selection simple.

Manage My Data

A new area called ‘Manage My Data’ has been added within System Set-up. As well as the ability to bulk-delete all system test data, you can find information on how your data is stored, transmitted, and hosted.

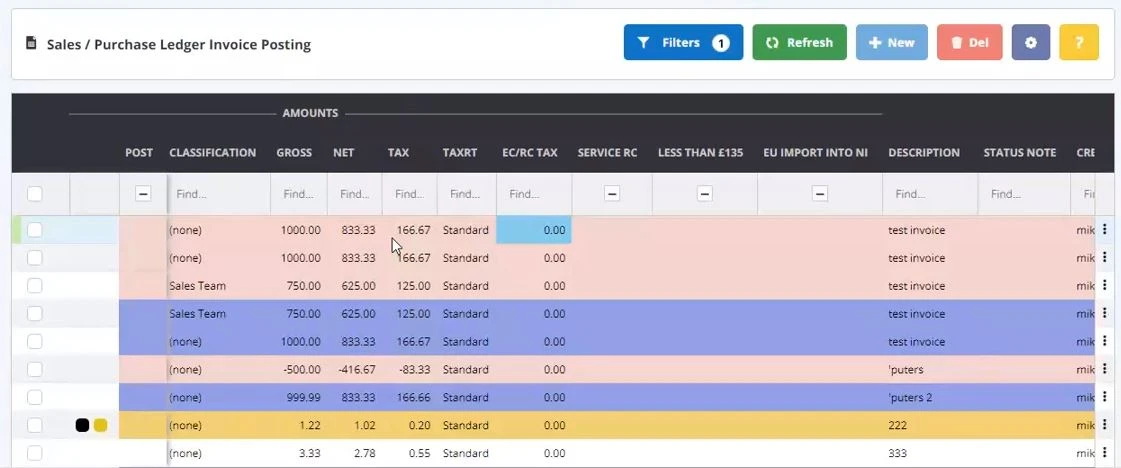

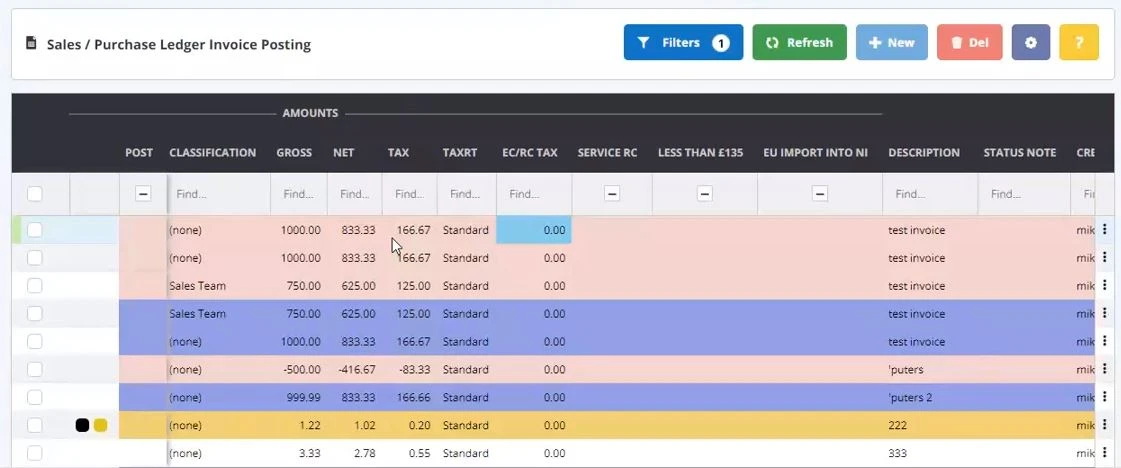

Additions to the SP Ledger

New fields within the SP Ledger now allow tax to be handled in multiple ways. That includes new columns to handle fringe cases; such as tax on Services and the expected Brexit exemptions for Northern Ireland.

Date Filters added to Stock Value Report

Within the Stock Value Report, you’re now able to filter by date. Whether you want to see Stock Values from a single month, or a across a year, the levels will be recalculated retrospectively to what they were between the dates specified.

New System Value Options around Brexit

As well as special options relating to Northern Ireland, the system now features a Brexit ‘Test Mode’ button. When Brexit features are active on a non-live database, this option will enable Brexit behaviour before the transition date, for testing.

To find out more about these changes in the system, please visit our dedicated Khaos Control Cloud resource. (Note, these pages are a work in progress and will be updated regularly).